What Is a Home Mortgage?

Our first-time buyer mortgage guide helps take the mystery out of a home mortgage. A home mortgage is a loan you use to buy a house. It’s an agreement between you and a lender that allows you to borrow money to purchase a home, with the promise that you’ll repay it over time—typically 15 to 30 years—with interest.

The house itself serves as collateral, meaning the lender can take possession of it (through foreclosure) if you fail to make your payments.

How Do Mortgages Work?

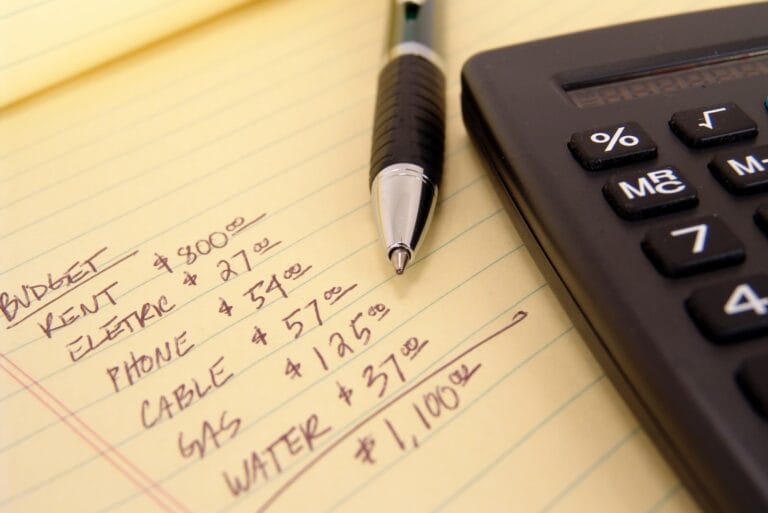

When you take out a mortgage, you agree to a structured repayment plan. Each monthly payment typically includes:

- Principal – the amount you borrowed

- Interest – the lender’s charge for lending you money

- Property taxes

- Homeowners insurance

- (Optional) Private mortgage insurance (PMI) if your down payment is less than 20%

Understanding how mortgages work is crucial for making smart financial decisions when buying a home.

Types of Home Mortgages

There are several types of home mortgage loans to consider, each with its own advantages depending on your financial situation and goals.

1. Fixed-Rate Mortgage

With a fixed-rate mortgage, your interest rate stays the same for the life of the loan. This means your monthly principal and interest payment won’t change, making budgeting easier.

2. Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage starts with a lower fixed interest rate for a set period (e.g., 5 or 7 years), after which the rate can adjust annually. These loans can save you money early on but may become more expensive over time.

3. FHA Loans

FHA loans are backed by the Federal Housing Administration and are ideal for first-time buyers with lower credit scores or smaller down payments (as low as 3.5%).

4. VA Loans

VA loans are for veterans and active-duty military members. They require no down payment and no PMI, making them a valuable benefit for eligible borrowers.

5. USDA Loans

Designed for rural homebuyers, USDA loans offer zero-down financing for eligible properties in qualifying areas.

How to Apply for a Mortgage

The mortgage application process can seem overwhelming, but breaking it down into steps helps:

- Check your credit score – A higher score qualifies you for better rates.

- Get pre-approved – Shows sellers you’re a serious buyer and gives you a clear budget.

- Compare lenders – Look at interest rates, fees, and customer service.

- Submit documentation – Including income verification, tax returns, and bank statements.

- Home appraisal and underwriting – Lenders assess the home’s value and finalize the loan.

- Close on the home – Sign the paperwork and officially become a homeowner!

Tips for First-Time buyers

- Save for a larger down payment to reduce monthly costs and avoid PMI.

- Don’t max out your budget—buy within your means.

- Consider total housing costs, including maintenance, utilities, and taxes.

- Shop around for mortgage rates to get the best deal.

- Get pre-approved before house hunting to streamline the buying process.

Fixed vs. Adjustable Mortgage: Which Is Better?

| Feature | Fixed-Rate | Adjustable-Rate (ARM) |

|---|---|---|

| Interest Rate | Stays the same | Changes after intro period |

| Monthly Payment | Predictable | Can increase over time |

| Best For | Long-term buyers | Short-term buyers or refinancers |

If you plan to stay in your home for a long time, a fixed-rate mortgage offers stability. But if you’re planning to move or refinance within a few years, an ARM could save you money upfront.

Final Thoughts on Mortgages

Home mortgages are one of the most important financial decisions you’ll make. Understanding the different types of loans, how the mortgage process works, and what fits your budget can set you up for long-term success as a homeowner.

Whether you’re buying your first house or refinancing your current one, educating yourself on mortgage basics can help you make smarter, more confident decisions. We hope this first-time buyer mortgage guide has been a helpful tool in taking at step towards home ownership.