What Is Personal Budgeting?

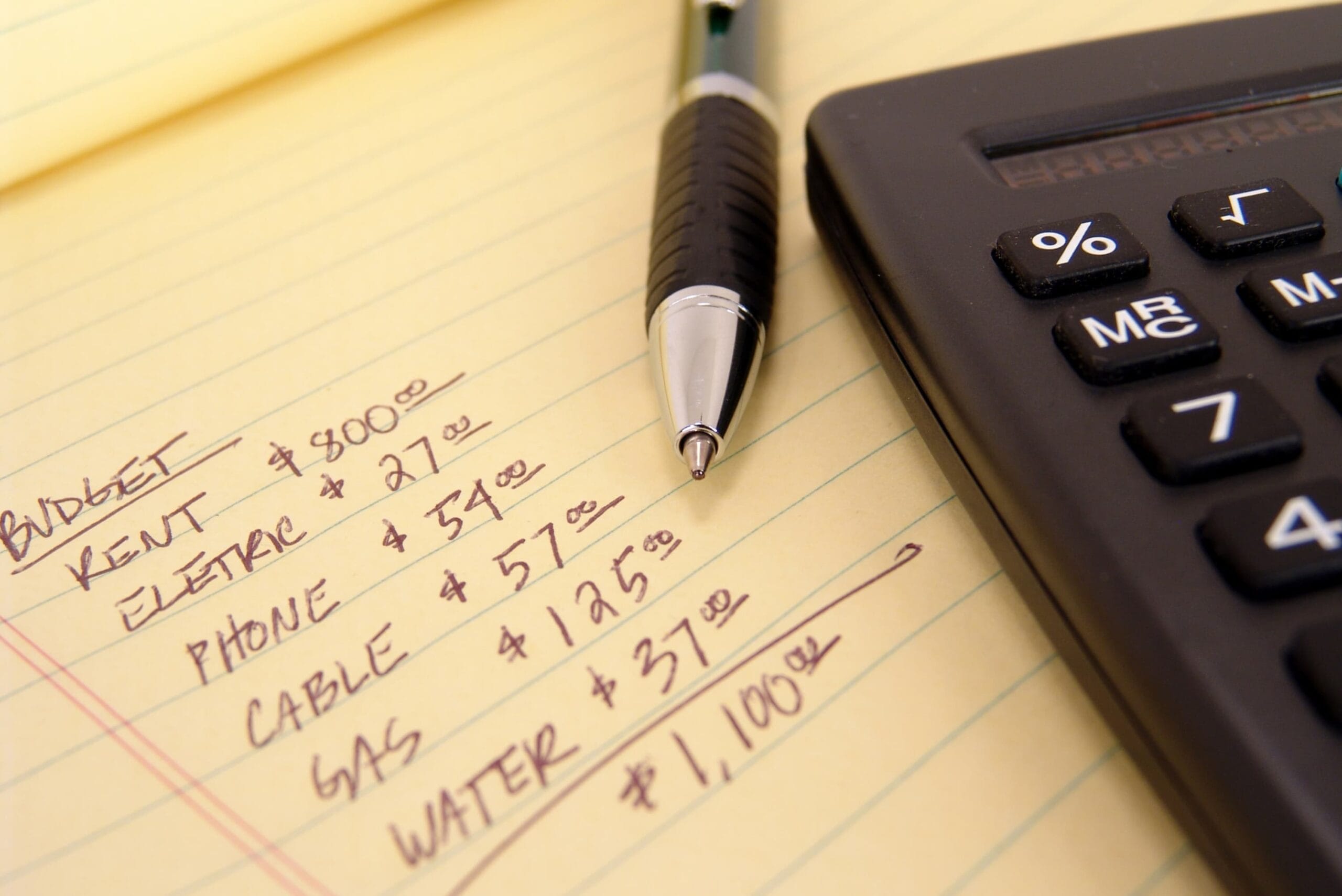

Personal budgeting lets you take control of your finances and is the process of creating a plan to manage your income, expenses, savings, and financial goals. It helps you understand where your money is going, so you can make smarter decisions, avoid debt, build long-term wealth and take control of your finances.

Whether you’re trying to pay off debt, save for a big purchase, or simply reduce financial stress, budgeting is the foundation of financial success.

Why Is Budgeting Important?

Budgeting isn’t about restriction—it’s about intention. Here’s why budgeting matters:

- Gives you control over your money

- Prevents overspending and unnecessary debt

- Helps you save for emergencies, retirement, and big goals

- Reduces financial anxiety

- Improves financial habits and discipline

Step-by-Step Guide for Personal Budgeting

1. Calculate Your Monthly Income

Start by figuring out how much money you bring in each month from all sources:

- Salary or wages (after taxes)

- Side hustle or freelance income

- Passive income (dividends, rental income, etc.)

Knowing your true income sets the foundation for your budget.

2. Track Your Expenses

Break your spending into two main categories:

- Fixed expenses: Rent/mortgage, insurance, car payments, utilities

- Variable expenses: Groceries, gas, entertainment, dining out

Use budgeting apps like Mint, YNAB, or EveryDollar to track where your money goes.

3. Choose a Budgeting Method

Pick a system that fits your lifestyle:

🔹 50/30/20 Rule

- 50% for needs (housing, food, transportation)

- 30% for wants (dining out, hobbies, entertainment)

- 20% for savings and debt repayment

🔹 Zero-Based Budget

Assign every dollar a job, so income minus expenses equals zero. Ideal for those who want full control over their money.

🔹 Envelope System (Cash Budgeting)

Divide your spending into envelopes for each category. Once the envelope is empty, you stop spending in that category.

4. Set Financial Goals

Budgeting is easier when you’re working toward something. Set short-term, mid-term, and long-term goals:

- Short-term: Build a $1,000 emergency fund

- Mid-term: Pay off credit card debt

- Long-term: Save for a home or retirement

5. Adjust and Improve Monthly

Budgets aren’t set in stone. Life changes—so review your budget monthly and make adjustments as needed. Over time, you’ll get better at predicting expenses and sticking to your plan.

Common Budgeting Mistakes to Avoid

- Underestimating expenses

- Not accounting for irregular bills (like annual subscriptions or car maintenance)

- Forgetting to budget for fun—you’ll burn out

- Skipping savings—even small amounts add up

- Not tracking progress

Avoid these, and you’ll set yourself up for long-term success.

Best Budgeting Apps in 2025

- Mint – Great for beginners, free, automatic syncing

- YNAB (You Need a Budget) – Best for hands-on, goal-driven budgeting

- EveryDollar – Simple, zero-based budgeting by Dave Ramsey

- Goodbudget – Great for envelope budgeting fans

- PocketGuard – Helps prevent overspending

Final Thoughts on Personal Budgeting

Personal budgeting lets you take control of your finances and is a powerful tool that can change your financial life. It helps you live within your means, achieve your goals faster, and feel confident about your money.

Whether you’re living paycheck to paycheck or working toward financial independence, creating and following a budget is your first step toward financial freedom.