Struggling With Credit Card Debt? You’re Not Alone

Millions of people carry credit card debt, often with high interest rates that make it hard to get ahead. The good news? With a plan, you can start paying down your balances and regain control of your finances. In this guide, you’ll learn the best strategies to pay off credit card debt, how to avoid common traps, and tips to stay debt-free long-term.

Why It’s Important to Pay Off Credit Card Debt

High-interest credit card balances can drain your budget, limit your financial options, and damage your credit score. Here’s why tackling your debt matters:

- Reduce interest payments: The longer you carry a balance, the more interest you pay.

- Improve your credit score: Lowering your credit utilization ratio boosts your score.

- Free up money: Every dollar you save on interest can go toward savings or investments.

- Lower stress: Living debt-free offers peace of mind and financial freedom.

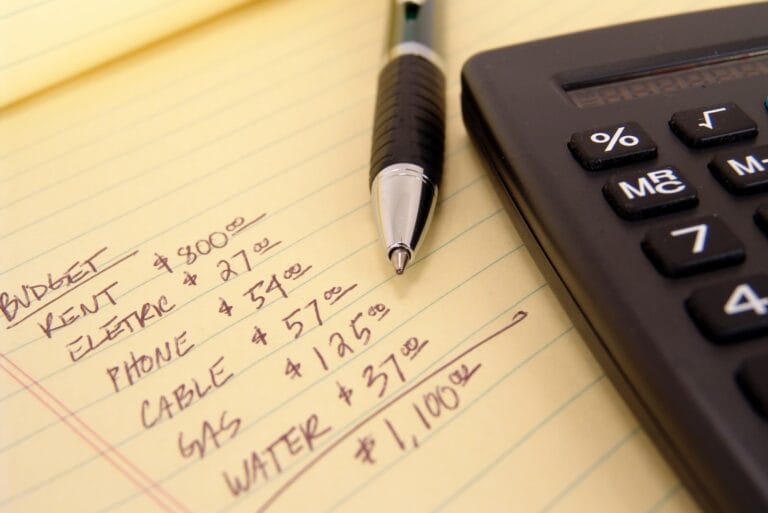

1. Know How Much You Owe

Start by listing all your credit cards, balances, interest rates, and minimum payments. This will help you create a debt payoff strategy that fits your situation.

Tip: Use a spreadsheet, budgeting app, or debt tracker to keep everything organized.

2. Choose a Debt Payoff Method

There are two proven ways to pay off credit card debt:

🔹 Debt Snowball Method

- Pay off the smallest balance first, while making minimum payments on others.

- Once paid off, roll that payment into the next smallest debt.

- Motivating for quick wins, great for building momentum.

🔹 Debt Avalanche Method

- Focus on the highest-interest rate card first.

- Pay minimums on others, then throw extra money at that high-interest debt.

- Saves the most money over time.

Choose the method that best fits your personality and financial goals.

3. Stop Adding New Debt

This step is critical: Stop using your credit cards while you’re paying them off. Stick to a cash, debit, or budgeted system so you don’t undo your progress.

4. Consider a Balance Transfer Card

A 0% APR balance transfer credit card can give you a break from interest for 12–18 months. This can help you pay off debt faster—if you’re disciplined and pay it off before the promotional period ends.

Warning: Watch for transfer fees and make sure you don’t miss payments, or the interest rate may jump.

5. Consolidate With a Personal Loan

A debt consolidation loan allows you to combine multiple credit card balances into one fixed monthly payment—often with a lower interest rate. This can simplify repayment and reduce total interest.

Look for lenders offering:

- Low APRs

- No prepayment penalties

- Flexible terms

6. Boost Your Income or Cut Expenses

The more money you can throw at your debt, the faster you’ll be free.

- Side hustles: Freelance, gig work, part-time jobs

- Sell unused items: Clothes, electronics, furniture

- Cut unnecessary spending: Dining out, subscriptions, impulse purchases

7. Automate and Track Your Progress

Set up automatic payments for at least the minimum amount, and manually add extra whenever possible. Watching your balances shrink can keep you motivated.

Apps like Mint, YNAB, or Undebt.it can help track your progress.

8. Get Help if You Need It

If you’re overwhelmed, consider:

- Credit counseling through a nonprofit agency

- Debt management plans (DMPs)

- Speaking with a certified financial advisor

Avoid debt settlement or for-profit companies that promise quick fixes—they often come with risks and fees.

Final Thoughts on Strategies to Pay off Credit Card Debt: It’s Possible!

It might feel overwhelming now, but paying off credit card debt is one of the best financial moves you can make. With the right plan, some discipline, and a bit of patience, you can eliminate your debt, improve your credit, and start building real wealth.