Building wealth isn’t about winning the lottery or getting lucky in the stock market—it’s about smart planning, consistent habits, and long-term vision. Whether you’re just starting out or looking to optimize your financial journey, here’s a clear, actionable guide on how to build wealth the right way.

What Does Building Wealth Really Mean?

Wealth isn’t just having money—it’s about having financial security, freedom of choice, and the ability to live life on your own terms. At its core, building wealth means creating and growing assets that generate income and appreciate in value over time.

1. Start With a Strong Financial Foundation

Before you invest, save. Here’s how to set the stage:

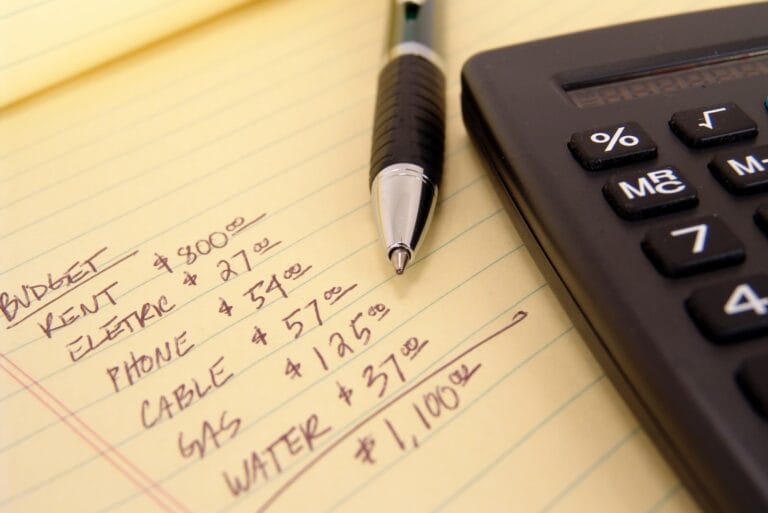

- Create a budget: Track your income and expenses to understand where your money goes.

- Build an emergency fund: Save 3–6 months’ worth of expenses in a high-yield savings account.

- Eliminate high-interest debt: Focus on paying off credit cards and loans with high APRs first.

📌 Pro tip: Financial stability is the first step toward financial freedom.

2. Save Strategically

It’s not just about saving money—it’s about saving with intention.

- Automate your savings: Set up automatic transfers to your savings and investment accounts.

- Take advantage of tax-advantaged accounts: Max out your 401(k), Roth IRA, or HSA.

- Use the 50/30/20 rule: Allocate 50% to needs, 30% to wants, and 20% to savings/investing.

3. Invest for the Long Term

Investing is key to building long-term wealth. Start with:

- Stock market investing: Low-cost index funds or ETFs are great for beginners.

- Real estate: Rental properties can generate passive income and long-term appreciation.

- Compound interest: Start early—compound growth is one of the most powerful wealth-building tools.

🧠 Fun fact: If you invest $500/month at a 7% return starting at age 25, you’ll have over $1 million by retirement.

4. Increase Your Income

Don’t just focus on cutting expenses—grow your income:

- Negotiate your salary

- Start a side hustle

- Invest in skills and education

- Build passive income streams like dividends, royalties, or online businesses

5. Protect What You Build

Wealth needs to be protected to last:

- Get insured: Health, life, and disability insurance can prevent financial disaster.

- Plan your estate: Create a will and consider trusts if your assets are significant.

- Diversify your investments: Spread your money across different asset classes to reduce risk.

Final Thoughts: Wealth Building Is a Marathon

The secret to building wealth isn’t flashy—it’s discipline, patience, and consistency. Make smart financial choices, invest early and often, and let time do the heavy lifting. Financial freedom is possible, and the best time to start is today.